Get the free td loan application pdf personal form - susquehanna

Show details

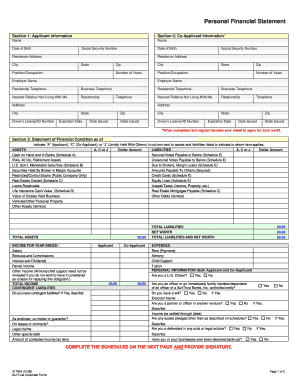

PERSONAL FINANCIAL STATEMENT SUSQUEHANNA BANISHES, INC. If you are applying for individual credit in your own name and are relying on your own income or assets and not the income or assets of another

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your td loan application pdf form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your td loan application pdf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit td loan application pdf online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit td loan application pdf. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

How to fill out td loan application pdf

01

To fill out the TD Loan Application PDF, start by downloading the form from the official TD Bank website or obtaining a physical copy from a TD Bank branch.

02

Gather all the required documents and information before starting to fill out the form. This may include personal identification, proof of income, employment details, and any other relevant financial information.

03

Begin by entering your personal information in the designated sections of the TD Loan Application PDF. This typically includes your full name, address, Social Security number, and contact information.

04

Proceed to provide details about your employment status, including your current employer's name, address, and contact information. You may also need to provide information about your job title, length of employment, and monthly income.

05

If you have co-applicants or co-borrowers, fill in their information in the appropriate sections. This may include their personal details, employment information, and relationship to you.

06

Move on to the section where you will specify the loan details. Indicate the type of loan you are applying for, the loan amount, and the purpose of the loan.

07

Complete the sections related to your financial information, such as your assets, liabilities, and monthly expenses. Be sure to provide accurate and up-to-date information to the best of your knowledge.

08

Double-check all the information filled in the TD Loan Application PDF to ensure its accuracy and completeness. Any errors or missing information could delay the loan application process.

09

Once you have thoroughly reviewed the form, sign and date it along with any co-applicants or co-borrowers. The signature(s) indicate your consent to the terms and conditions of the loan application.

Who needs the TD Loan Application PDF?

01

Individuals who are interested in applying for a loan from TD Bank may need the TD Loan Application PDF. This includes potential borrowers seeking personal loans, auto loans, home equity loans, or any other type of loan offered by TD Bank.

02

Those who prefer to complete their loan application offline or in a paper format may find the TD Loan Application PDF useful. It allows for the convenience of filling out the form at their own pace and in a physical format.

03

Applicants who want to ensure they have all the necessary information and documentation required for the loan application process may benefit from the TD Loan Application PDF. It provides a comprehensive overview of the details and documents needed, helping applicants prepare in advance.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is td loan application pdf?

TD loan application PDF refers to the loan application form provided by TD Bank in a Portable Document Format (PDF). TD Bank is a financial institution that offers various types of loans to its customers, such as personal loans, car loans, and home equity loans. The TD loan application PDF is a standardized form that needs to be completed by the borrower when applying for a loan with TD Bank. This form usually requires personal and financial information, employment details, and information about the loan being applied for. The PDF format allows the form to be easily viewed and printed by the applicants.

Who is required to file td loan application pdf?

The individual or entity interested in obtaining a loan from TD Bank is required to file the TD loan application PDF. This could be a business owner, a student applying for an education loan, or any individual seeking personal financing.

How to fill out td loan application pdf?

To fill out a TD loan application PDF, follow these steps:

1. Open the TD loan application PDF on your computer.

2. Click on the first field where you need to input information. This will activate the text box or drop-down menu.

3. Begin typing the required details into the field. If it is a drop-down menu, click the arrow to select the appropriate option.

4. Continue filling out all the required fields in the application form, including personal information, contact details, employment information, and loan details.

5. Review the filled-out form to ensure accuracy and completeness.

6. If there are any additional sections or documents that need to be attached, make sure to do so.

7. Save the completed application form on your computer.

8. Optionally, you can print a hard copy for your records.

9. Submit the completed form as per the TD loan application instructions, either by uploading it online, mailing it, or visiting a TD branch in person.

What is the purpose of td loan application pdf?

The purpose of a TD Loan Application PDF is to provide customers with a standardized format for applying for a loan with TD Bank. The PDF document typically includes sections for personal information, employment details, loan amount and purpose, as well as any additional information or documentation required. This form allows customers to fill out the necessary information in a structured manner, making it easier for TD Bank to process the loan application efficiently and accurately.

What information must be reported on td loan application pdf?

The information that must be reported on a TD loan application PDF typically includes:

1. Personal information: Name, address, contact information, Social Security number, date of birth, and employment details.

2. Loan details: The purpose of the loan, loan amount, desired term, and whether it is for an individual or joint application.

3. Financial information: Income details, including employment status, employer information, and monthly income. It may also require information about other sources of income or assets.

4. Assets and liabilities: Information about current assets such as savings, investments, and property owned. It may also require reporting of any outstanding debts or liabilities.

5. Citations and judgments: Disclosure of any lawsuits, bankruptcies, or other legal actions involving the applicant.

6. Consent and authorization: The applicant's consent to the bank's terms and conditions, as well as authorization for the bank to obtain credit reports and verify the provided information.

7. Other required documents: The application may also require supplemental documents such as identification proof, income statements (pay stubs, tax returns, etc.), and bank statements.

It's important to note that specific requirements may vary depending on the type of loan and legal regulations in the location where the loan is being applied for. Therefore, it is advisable to carefully review the application form and any accompanying instructions provided by TD Bank.

What is the penalty for the late filing of td loan application pdf?

TD Bank does not publicly disclose the specific penalties for late filing of its loan application PDF. Therefore, it is recommended to contact TD Bank directly or refer to the loan agreement for detailed information regarding late filing penalties.

How do I execute td loan application pdf online?

pdfFiller has made filling out and eSigning td loan application pdf easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

Can I create an eSignature for the td loan application pdf in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your td loan application pdf and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I edit td loan application pdf on an iOS device?

Create, edit, and share td loan application pdf from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

Fill out your td loan application pdf online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.